第九章 为什么投机者(几乎)老是做多?(1)

Why Is the Speculator (Almost) Always Long?

I could hardly believe what I was hearing from the voice on the phone. We were talking about long-term trading systems, and the gentleman from South Dakota was bemoaning the fact that he had been continuously whipsawed in the Chicago grain markets throughout 1995. “I certainly hope we get some good grain trends in 1986,” he went on, “because I can’t take much more of these crazy, trendless markets.” Crazy, trendless market, I mused. What can he possibly be talking about?

从电话听筒中听到的事情,几乎令人不敢相信。听筒彼端是南达科塔州一位仁兄,我们所谈的是长期交易系统的事情。那位老兄抱怨,1985整年,他老是在芝加哥谷物市场一而再,再而三惨遭上下洗盘。“我当然希望1986年谷物市场有一些好的趋势出现,”他滔滔不绝地说,“因为我已经受够了这个要命,没趋势的市场。”要命,没有趋势,我口中喃喃念着,他怎么好意思说这种话?

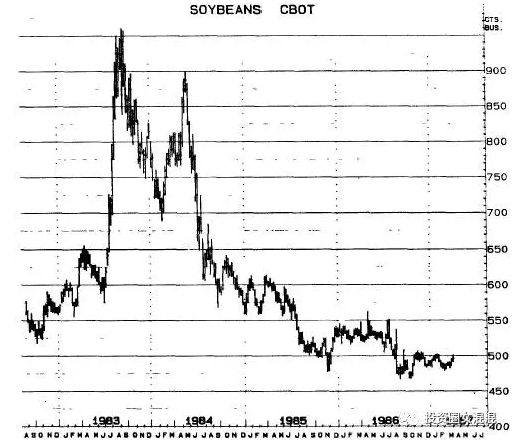

Grains had been in a dynamic downtrend for nearly all of 1985 – corn had declined from 2.85 in April to 2.20 by September. Wheat had slipped from 3.60 in March to 2.75 by July – and that’s $4,250 per contract. And finally there were soybeans, which had absolutely astounded the Chicago bean-watchers by declining almost continuously since June of 1984 (see Figure 9-1). In fact, some of the astute systems traders, who had heeded the clear sell signal on the afternoon of June 11, 1984, were sitting with about $12.000 in open profits (per contract) on the short bean position. These ultimately closed out on December 16, 1985, with a $10,500 profit.

1985年几乎一整年,谷物市场一路跌个不停——玉米从4月的2.85跌到9月的2.20。小麦从3月的3.60跌到7月的2.75——那相当于每份合约4250元。最后是黄豆,叫芝加哥注意黄豆动向的人吃惊,因为它几乎是从1984年6月就开始节节下滑,没有停过(见图9-1)。事实上,有些精明的系统交易者,在1984年6月11日下午就注意到十分清楚的卖出信号,因为做空黄豆,可坐收12000元的未平仓利润(每份合约)。到了1985年12月16日最终平仓出场时,利润是10500元。

图9-1 (最近期)黄豆长期周线图

【Soybeans had been in a major bear market since mid-1984, on the failure of the rally at the 9.00 level. Can you imagine a trader calling the market action during 1985 trendless? It is about as classic a downtrend as you will ever see. Astute position traders, who were willing to take a short position in an obvious bear market, scored significant profits.

1984年年中黄豆在9.00处反弹失败后,就一直处于大空头市场。你能想象竟然有位交易者说1985年的市场根本没有趋势?它就跟你看过的所有典型的下跌趋势完全一样。精明的仓位交易者,在明显的空头市场中,一定会做空,而赚到很多的利润。】

What the gentleman from South Dakota really meant – although he may not have realized it – was that he hoped the grain markets would turn up, simultaneously turning up his confidence factor, so that he could load up on the long side and make some money.

南达科塔那位老兄真正的意思——也许他根本不知道——是希望谷物市场上涨,同时引导他的信心上升,好让他做多,赚些钱。

Have you ever noticed that when the average trader says that the market is “good,” he means that the trend is up and that he is long? When he describes the market as “bad,” he means that the trend is down and that he is long. Long either way, it seems. But here, he is stuck with a painful losing position in a clear-cut bear market.

你是不是注意到?一般交易者说某市场“不错”时,其实他的意思是说市场上涨,而他也正好做多。当他说市场“很糟”时,其实他的意思是说市场下跌,而他正好不幸做多。似乎不管市场趋势如何,反正他就是做多。但是在明眼人都知道的空头市场里,他却套牢在亏钱的仓位里,欲哭无泪。

I suppose that it is human nature to look forward to advancing, rather than declining, prices and values. Since the end of World War II, inflation has been steadily entrenched in the world economy, despite its apparent slowdown during the late 1980s. We have been convinced by the politicians and the media that inflation is healthy and desirable both for the economy and the individual. After all, who really wants to earn less in one year than he did the year before? Who wants the value of his house, property, or business to be less in one year than the previous one? One might even be accused of being antisocial or even un-American for anticipating or actually profiting from declining prices or economic values.

我想,人的天性总是希望见到价格或价值节节高升,而不是一路下滑。第二次世界大战结束以后,全球经济中通货膨胀一直顽固且稳步上涨,即使在80年代末明显减慢步伐,物价还是在上涨。我们一直被政治家和媒体所骗,以为不论对整个经济还是对个人来说,通货膨胀都是件很健康而且很好的事情。毕竟,谁愿意今年赚的钱比去年少?谁愿意自己的房子,财产,事业今年的价值不如去年?如果有人想从价格或经济价值下跌的情况下大捞一笔,可能会被人骂为大逆不道,甚至说他根本不是美国人。

But politics and economic theory aside, the inescapable truth is that markets do trend down about half the time, that “they slide faster than they glide,” and that experienced and successful operators know they can often achieve more reliable and quicker porfits on the short side of a market than on the long side.

我们暂且不谈政治和经济,不可否认的一个真理是:市场确实有一半左右的时间是在下跌,而且“滑的比飞的还快”。有经验和成功的交易者知道,下跌的市场要比上涨的市场,赚钱更稳而且更快。

A major impediment to the average speculator catching significant down moves with any degree of consistency is his-and probably his broker’s-innate bias for the long side of any market. Even when the trend is obviously down, our erstwhile speculator will clings to the hope that prices will reverse or, more specifically, that he will catch that reversal and make a big score. That has always been and will surely continue to be a most expensive speculative bias.

一般投机者要抓住显著的下跌趋势,而且要能在某种程度内经常抓住,一个重大的障碍,就是他对任何市场天生就有一种看多的心理——他的营业员可能也是这样。即使趋势是很明显的下跌,很多投机者还是固执地希望价格最终会反弹,或者讲明些,他们以为自己能够抓住反转点,大赚一笔。这种投机方式,以前是很昂贵的做法,将来依然一样昂贵。

Rather than clinging to such subjective and hopeful visions, the responsible speculator should operate on the basis of some objective and viable approach – either something he has created himself, a service or market letter to which he subscribes or one of the computer-oriented trading systems now on the market. But having a viable method or system will not itself develop profits – it must be used the way it was intended, consistently and in a totally disciplined manner. And that means following all the signals generated by the method or system, and not just the “buy” signals or the ones that support the trader’s personal biases.

想要有所成就的投机者,不应该有这种主观和一厢情愿的想法,而应该运用客观和可行的方法去交易。这种方法可以是他自己创造的,也可以是他订的服务或市场报告,或者是目前市场上出售的电脑交易系统。但是,有了可行的方法或系统之后,并不能保证财源就会自动滚滚而来——使用的时候,应该按照它原来的目的去用,前后一致,而且要严守纪律。这表示,你的方法或系统发出的所有信号,你都要执行,而不是只看到“买入”的信号,或是证实自己个人的偏见没错的信号,才照着去做。

I once wrote an article discussing the overwhelming penchant that traders have for the long side of the market, even in the face of an overall bearish price trend. A number of people wrote to me suggesting that this particular market bias was principally a public speculator’s approach and that experienced operators would more realistically respond to bearish markets by placing their bets on the short side.

我曾写过一篇文章,讨论即使市场是明显的空头,交易者却偏爱做多的现象。很多人写信告诉我,这种特殊的市场偏好主要是投机大众所采用的方法,有经验的交易者也会下注做空,并采用务实的态度。

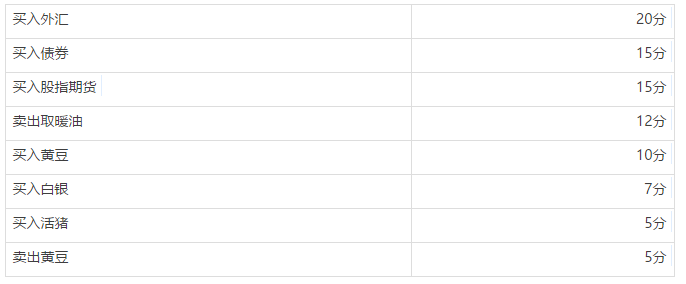

It’s difficult to prove either point. How can you get a bunch of professional traders or analysts to divulge their real market positions? But, just such a glimpse becomes available twice yearly, in the guise of The Wall Street Journal’s semiannual survey of 20 leading commodity experts. The survey consists of buy and sell recommendations for the coming six months. The following ratings were made in January 1984 and are based on the expert’s rankings, with three points given to a first choice, two points given to a second choice, and one point given to a third choice.

很难证实以上观点。你要用什么方法去叫一大堆专业交易者或分析师透露他们真正的市场仓位?不过,《华尔街日报》每半年调查一次20位知名商品专家的意见,我们每年有两次机会了解真实情况。专家会对未来半年内的商品给出买入和卖出的建议:第一个选择给3分,第二个选择给2分,第三个选择给1分。

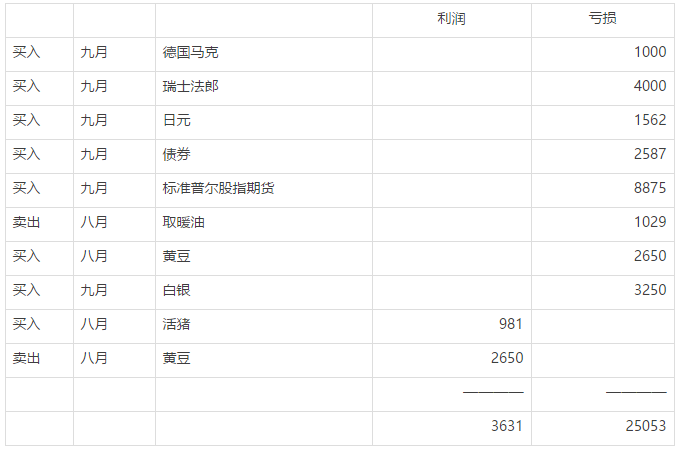

The results speak for themselves; six of the eight recommendations were buys, not withstanding the fact that futures markets were generally forming a major top from which prices would be moving south for the next two-plus years. As a matter of fact, only two of the eight recommendations resulted in profits, and these were – can you guess? – the two lowest-rated recommendations: buy hogs and sell soybeans. If you tally the market performance of these eight “best bets” for the first half of 1984, you would find a most startling conclusion. The following calculations are based on a one-contract position in each market.

这个结果一目了然:8位专家里面有6位建议买入,而无视于期货市场已普遍形成一个大头部,即将在未来两年多的时间里一路下跌。事实上,8个建议中只有2个后来能够赚到钱,它们是——你先猜猜?——评分最低的2个:买入活猪和卖出黄豆。如果你把1984年上半年8个“最好的投资”依序列出它们的实际表现,结论会叫你感到吃惊。以下计算出来的数字,是在每个市场以一份合约为准得到的:

Now, I do not suggest that someone would, in fact, have lost all that money. At some point in the slide, the trader would probably have close out at least some of the losing positions and perhaps even have taken to the short side. Nevertheless, this summary bears ample witness to the fact that buy recommendations vastly outnumber sell recommendations regardless of the market and regardless of the operator’s experience and sophistication. The same phenomenon is found among stock recommendations issued by brokerage firm analysts, where buy recommendations typically prevail over sells by nine to one!

这里我并不是要说有些人会把所有的钱输光。下跌趋势跌到某个地方,交易者有可能已经把一些亏钱的仓位给平掉,甚至转而做空。不过,从上面那份总结表里,我们可以看到不管是哪个市场,不管交易者过去的经验或心思缜密的程度如何,买入的建议真的是多于卖出的建议。股票经纪公司发表的选股建议,也可以看到相同的现象:买入建议与卖出建议的比例是9︰1!

The results of the summary also testify to the extreme difficulty (impossibility?) of attempting to predict the course of futures prices. Whereas, even an expert might be right on any given prediction, when you get down to a broad list of predictions, our expert is likely to bat far less than 50 percent. Another truth is self-evident here – reasonable stop protection is essential to prevent what could be just a modest and acceptable loss from deteriorating into a financial disaster.

从摘要表的结果也可以看出,要预测期货价格十分困难(不可能?)。不过,虽然专家所做的预测也有正确的时候,只是如果你有心把他们所做的预测一一纪录下来,你就发现,他们的正确率可能不到50%。这里出现另一件不言而喻的事情,也就是——合理的止损是必要的保障,以免可以接受的小损失演变成一发不可收拾的财务大灾难。

每日精彩,欢迎扫描二维码关注期乐会微信公众平台。

感谢作者辛苦创作,部分文章若涉及版权问题,敬请联系我们。

纠错、投稿、商务合作等请联系邮箱:287472878@qq.com