第十七章 市场无好坏之分

The Market Is Neither Good Nor Bad

During much of the early 1980s, the tax shelter issue was of major concern to both the financial community and the federal government. On the one hand, the IRS and Congress focused on tightening or eliminating alleged loopholes. Indeed, the very heart of a huge tax-shelter industry was wiped out at one fell swoop with the signing of the Economic Recovery Act of 1981. Thus was ended the established practice, through tax straddles and subsequent rollovers, of an investor being able to convert short-term into long-term capital gains while deferring the tax liability by one or more years.

80年代初,很多时候,合理避税是金融界和联邦政府最关心的话题。一方面,国税局和国会重点收紧和消灭法律漏洞。事实上,1981年的《经济复生法案》已经把庞大的能利用合理避税的产业消灭了。一些既有的做法,比如税收套利和税收翻滚都不能用了。投资者不再能够把税负延到1,2年以后让短期的资本收益变成长期资本收益。

As a counterpoint, many in the financial community – commission firms, floor brokers, accountants and attorneys, and large investors-spent considerable time and money seeking ways to create new and viable shelters to replace those the government had voided.

相应地,金融业中的很多人,包括经纪行、营业厅经纪人、会计师、律师和投资大户——花了很多时间和金钱,想方没法创造可行的新的合理避税方法,以取代政府明令禁止的老方法。

But it was left to we commodity traders to unwittingly and unintentionally create a huge volume of perfectly legal, unassailable tax shelters. In fact, this type of shelter was so legitimate and straightforward, it hurt – literally! I’m talking about trading losses – losing money, and lots of it, by being on the wrong side of highly leveraged, fast-moving markets.

我们这些商品交易者无意中创造出无数完全合法,无懈可击的避税方法。事实上,这些避税方法确实合法且单刀直入,结果却十分伤人——从字面上讲。我讲的是在这个高杠杆效应,瞬息万变的市场中如果押错边就会亏钱,而且是大亏。

To this dubious list of tax shelter innovators, I must regretfully add my own name as well as the names of many of my colleagues, most of whom are professional operators with long years of established success. And we should have known better!

这些避税方法发明者的名单中,我也是其中一员,其他还包括很多同行,他们大部分是专业交易者,有多年的成功纪录。我们本应该做得更好!

Isn’t it curious that when an investor makes money, he attributes it to skill, superior acumen, and clever timing. But when he loses money-well, the market was terrible, too volatile, excessively choppy. We even hear such exculpations as world illiquidity, interest rate uncertainty, and massive government deficits. We might as well blame the phase of the moon or sunspots (don’t snicker, some people do), the depth of trouser cuffs, or skirt hemlines.

投资者赚钱的时候,总是会说自己技术高超,洞察力敏锐,进出时机掌握的恰到好处。等到亏了钱,又说市场太恐怖,不稳定,过分波动。甚至怪罪到全世界资金流动性不够,利率前景不明,政府赤字太大。还有人说是因为月亮大小变化,太阳黑子运动(别笑,真的有人这么说),裤脚反边的宽度不对,裙子底缘大小不理想。这种赚了钱就说是自己的本事,亏了钱就怪罪到其它事情的心态不是很奇怪吗?

Why can’t we just admit that we were wrong in our perception of the market trend, our trade timing, or our tactical market approach. Only by acknowledging such pragmatism can we discover where and how we erred and how to avoid those mistakes the next time around.

我们为什么不能坦承自己对市场趋势看走了眼,交易时机不当,或者市场战术不对?只有采取务实态度,我们才有办法找出自己错在什么地方,怎么错的,下一次要怎么做才能避免再犯。

The universal truth about futures markets is that, except for occasional and short-term aberrant periods, markets and price trends are not, in themselves, good or bad, right or wrong. It is the speculator himself who is good or bad or, more specifically, right or wrong. Throughout history, canny and successful speculators have repeatedly discovered this basic truism. And this commentary goes way back; the buying and selling of commodities have been linked with organized commerce for at least 50 centuries. Active commodity markets, under rules and regulations, existed in China, Egypt, Arabia, and India centuries before the advent of Christianity. Even in those days, the winners probably called the markets good and the losers called them bad.

期货市场放诸四海皆准的一个真理是:除了一些偶发和短暂的异常时期外,市场和价格趋势本身并没有好坏与对错之分。明确地说,投机者本身有好坏与对错之分。自古以来,精明成功的投机者都发现了这个基本真理。而且这句话还可以回溯到久远的年代。商品买卖和有秩序的商业活动至少有5000年的历史。基督教产生之前,依据法律规定进行的活跃商品市场,就存在于中国、埃及、阿拉伯和印度。即使在那个时候,赚了钱的人也可能说市场很好,亏了钱的人则说市场很坏。

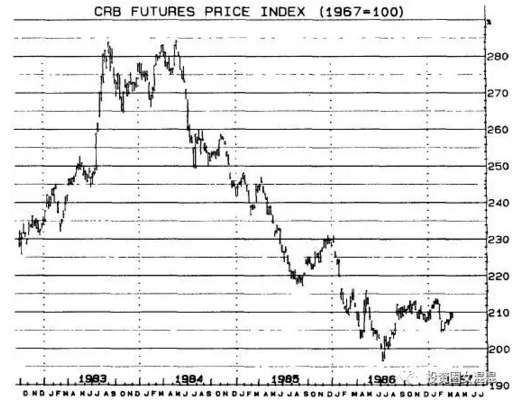

And so, during this recent period, from mid-1983 to 1986, the markets were fine, thank you. It was the majority of speculators, commission firms, and advisory letters who were substantially wrong-on both the direction and the magnitude of the underlying major (down) trend of most markets. In succinct Americanese, we “zigged” (bought) when we should have “zagged” (sold). See Figure 17-1.

照这么说,近代1983年年中到1986年之间,市场应该说是很好了。这段期间内,绝大部分的投机者、经纪行和投资报告都大错特错——他们都没抓对大部分市场主(下跌)趋势的方向和波动的幅度。用简洁的美国话来说,在我们应该左拐(卖出)的时候,却右转(买入)了。见图17-1。

图17-1 CRB期货价格指数(长期周线图)

【During the period mid-1983 to mid-1986, when markets were predominantly down, most speculators were still playing long. Color their monthly statements RED. The winners, who played the major (down) trend in an objective and disciplined manner went home with all the winnings. Color their statements, GREEN.

1983年年中到1986年年中,市场明显下跌,大部分投机者还在做多。每个月结算下来都是赤字。以客观和严守纪律的态度面对主(下跌)趋势的赢家,抱着所有奖品回家。当然了,他们的月报表是绿字。】

And, while the majority of traders had been playing the wrong (long) side of most futures and blaming their losses on “those crazy markets,” the winners – those who had been playing the (down) trends in a disciplined and objective manner – were convinced that they were in some great markets. Same markets, folks – just the difference between being right and wrong.

绝大部分的交易者玩了错误的一边,并把亏损怪罪到“疯狂没道理的市场”,但是赢家——一直用严守纪律和以客观态度顺势(下跌)交易的人——却深信这市场实在棒极了。同样的市场,吃同样米的人,对市场好坏的看法却截然不同。

In fact, during these choppy and random-appearing trends, with unexpected reversals and then reversals-from-reversals, it is more important than ever to play a disciplined and objective game. We all get whipped around, but it is important that you don’t allow the market to upset or unnerve you. During early 1984, I got whipped in a big T bill position despite my best resolutions to play by the rules. I had been short a line of September bills from February, held at a good profit, but was getting pretty unnerved at the independent strength of the June bills. Really strange, I thought to myself. I would have expected an expiring-month squeeze in something like meats or one of the grain markets. But in T bills? Anyway, the relentless strength of the spot June future so undid me that I covered my entire line of short Septembers only to find, the very next day, that the market collapsed and the Septembers were down 20 points on the opening-and that’s “only” $500 per contract. Too bad I didn’t have my Buy the Strength and Sell the Weakness chapter at that time – it would have been very useful. But, worse than prematurely stopping out of a good short position, I was so bothered by my undisciplined play in bills that I missed a good buy signal on September 10 that resulted in a $5,500 move-and completely missed the entire profit!

事实上,在波浪起伏,似乎漫无目标,意外的反转,反转又反转的市场中,严守纪律和保持客观的态度比以前还重要。我们都被市场上下洗过,但是你千万不要被市场惹得火冒三丈或失去勇气。1984年初,我建立了一个很大的国库券仓位,在严守纪律的情况下,被洗出了市场。那时我从2月起就做空9月国库券,利润不错,但见到6月国库券一枝独秀的强势,我失去了勇气。事后回想,这真是奇怪。我应该知道,像肉类或某些谷物市场,到期月份才有所谓的压榨行情,但是国库券怎会有呢?不管怎么样,见到6月现货展现的凌历强势,我退缩了,把整个9月空头仓全部平仓,隔天才发现崩跌,9月期货一开盘就跌了20点——每份合约500元。很可惜,当时我还没学到买强卖弱那一招,当时是很有效的。但是比过早止损退出空头仓的事情还糟的,是我被自己不守纪律的做法弄得心神不宁,以致在9月10日错过了一个很好的买入信号。根据这个信号买入的话,整个上涨波段可以赚到5500元,而我连一块钱都没赚到。

During these difficult periods, there are lots of clear-thinking and disciplined technical traders whose accounts appreciate from 20 to 40 percent and that’s not bad for these kind of years. One of the psychological problems that traders have to face, in terms of being right or wrong, is the subconscious reversal of two basic human emotions, hope and fear. Trader A is long beans in the direction of the major trend and is sitting with a profit. He sells on the first reaction fearing that if he continues to hold the position the market may reverse and he will lose his profit. Trader B, on the other hand, is short beans, against the major uptrend, and is sitting with a small but growing loss. He will sit with the losing position, hoping that the market will reverse its major trend (it probably won’t, at least not while he’s still short) and start moving south. In the meantime, the market continues in its major uptrend, and the loss continues to mount. What we have here are our principal emotions of hope and fear, but disoriented by 180 degrees. A, with his profitable, trending position in beans, should sit tight, hoping that the favorably moving market will continue to score profits for him. B, on the other hand, sitting with an unprofitable antitrend position, should close out, fearing that the adverse trend will continue (as it usually does) and the loss will continue to increase (it too, usually does).

在这些艰苦的年头里,还是有很多头脑清醒,严守纪律的技术交易者,账户每年增值20%——40%,他们反倒认为那是不错的年头。以对和错的角度来说,交易者必须面对的心理问题,是下意识里两种基本人性情绪的交互出现,也就是希望和恐惧此起彼伏。交易者A顺着主趋势的方向做多黄豆,而且坐拥利润。第一次回调时,他害怕市场反转,他就会失去本来的利润。相反的,交易者B逆主趋势做空黄豆,发生不大但不断增加的亏损。他会持有亏钱的仓位,希望主趋势会反转(也许不会,至少在他仍做空时不会)并就此开始下跌。与此同时,市场继续上涨,亏损继续增加。这里我们出现的是希望和恐惧两种基本情绪,但却是180度转向。A拥有赚钱的顺势仓,应该持有不放才对,希望有利的市场趋势能继续给他锦上添花。相反的B持有不赚钱的逆势仓位,应该平仓才对,因为他害怕不利的市场趋势会继续下去(就跟往常一样),亏损会继续增加(也跟往常一样)。

Yet the contradictions abound, and a key element in successful trading is the way an operator reacts to both good and bad markets; that is, to winning and losing. Joe Klein, one of the best floor traders of his day whose successful career spanned more than 50 years in both the New York and Chicago pits, put it very succinctly. “Anyone can be a hero when he’s long a big line and the market is moving sharply higher, with some limit-bid days thrown in. But the mark of a true professional is how he plays when he is behind; when the market is going against him and he can’t seem to regain his balance or his equilibrium.”

但是矛盾的状况俯拾皆是。成功的交易中有一件关键要素,就是交易者对好市场和坏市场的反应方式;也就是赢和输的方式。乔·克莱恩是他那个年代中最棒的现场交易者之一,飞黄腾达的事业生涯前后长达50多年,足迹遍及纽约和芝加哥的期货交易所。他简洁地说:“任何人都可以是个英雄,只要他大手笔做多,而市场也急剧上涨,甚至有些日子以涨停收市。但是真正的专业人士的金字招牌,在于他落后时是怎么玩的:市场对他不利,看起来他再也站不稳时,他的一举一动,值得我们注意。”

And Joe Klein should know. In contrast to today’s leading floor traders who tend to concentrate on a single pit or exchange floor, Klein was the perennial traveler. During the 1940s through the 60s, he kept an overnight bag under his desk in a small office at the Cotton Exchange. So equipped, he was ready to move with the action. If the bean or wheat market started jumping and Joe’s charts told him that he ought to play them seriously, he would grab his bag, hail a cab for LaGuardia Airport, and get on the next flight to the Windy City. And the Chicago boys wouldn’t be the least surprised to see Joe Klein step into the bean pit the following morning; after all, that’s where the action was.

乔·克莱恩应该知道他们是什么样子。今天的知名现场交易者,往往集中全力在一个柜台或交易所,克莱恩跟他们不同,他常年四处奔波。40年代到60年代,他在棉花交易所小办公室的桌子,老摆着一只旅行袋,有事时马上提着上路。如果黄豆或小麦市场开始跳涨,而且克莱恩的图告诉他,必须认真玩一玩时,他就会拎起旅行袋,坐辆计程车到拉爪地亚机场,坐下一班机到风城。隔天早晨,乔·克莱恩踏进黄豆交易柜台时,芝加哥交易所的人一点也不会惊讶:毕竟,那是采取行动的地方。

What does Joe Klein’s statement about winning and losing really mean? The true test of how expert or professional an operator is – and this just as applicable in any other field or profession – is the way the operator handles the bad times. I’ve seen many high-flying speculators, who had amassed substantial paper fortunes by getting on the right side of a dynamic one-way market (invariably heading north), lose their bundle and then some when the market turned south. The mark of the true professional is his staying power-his ability to weather the inevitable adversities and come out on top.

克莱恩关于赢和输的说法,真正的意思到底是什么?专家或者专业人士做为一个交易者,真正的考验——这也适用于其它任何专业领域——在于他们如何面对困难。我见过很多趾高气昂,不可一世的投机者,他们上对了动能十足的单向市场(通常是上涨市场),积累了庞大的帐面财富,一旦市场转而下跌,不但原来的财富转眼成空,还倒贴了老本。真正的专业交易者的标志,在于他们忍耐的力量——他们能够渡过不可避免的逆境,终而出人头地。

It is only human, of course, to become discouraged when trading goes badly. When, despite your best intentions and attempts at an objective and disciplined approach, just about every trade seems to turn bad. We all have times like these. I’ve found that the best thing to do when such moments arise is to walk away from the market for as long as it takes to get your head cleared and your attitude positive. The market will be there when you return. I am reminded of a story told about Dickson Watts, a famous old cotton trader from the 19th century. When asked for advice by a trader who claimed that the size of his position kept him awake at night, Watts’ reply was direct and on target: “Sell down to a sleeping level.” Have you ever been unable to sleep because of your futures position? Have you ever sold down to a sleeping level?

当然了,交易不顺时感到泄气,是人之常情。即使你极力保持客观态度和严守纪律,任何一笔交易还是有转坏的可能。我们都经历过这样的事。我发现,应付这种时刻的最好方式,是远离市场,待在场外,直到自己头脑清醒,态度变得积极为止。当你回去的时候,市场还会在那里。讲到这里,我不禁想起一个有关19世纪知名老棉花交易者迪克森·华兹的故事。有位交易者问华特兹,说他所做的仓位规模叫他晚上睡不好,该怎么办时,华特兹的回答正中目标:“那你就卖到你能够安睡为止。”你是不是也曾因为期货仓位而晚上睡不好觉?你是不是曾经把它们卖到自己能够睡个好觉为止?

第五期《赢乐-通向财富自由之路》

期货股票实战训练营

(点击图片查看详情)