KISS (Keep It Simple Stupid)

There's this guy I know named Joe, and his motto is KISS. It's not an expression of his amorous nature. It translates into,“keep it simple, stupid,” which aptly describes Joe's extremely successful approach to futures trading.

我认识一个人,他叫乔,他的座右铭是KISS。这并非表示他喜欢谈恋爱。KISS其实是keep it simple, stupid的缩写,也就是务求简单,简单到不必用大脑的意思。乔交易期货之所以那么成功,靠的就是这一点。

In early October 1985, Joe had been taking good profits on the long side of sugar and the short side of beans. Most of the markets had old and established trends then and were pretty crowded with commission house speculative long positions with a substantial quantity of sell-stop orders below the market. Under these conditions, Joe felt that the markets were pretty vulnerable to a bear raid by professional operators. Accordingly, he didn't fancy sharing the same side of the markets with a predominance of what he considered weak long holders. He was looking for a new and less crowded market to play in, and his attention was increasingly drawn to coffee. Joe characteristically avoided trading coffee – matter of fact, he didn't even drink the stuff! Between the sharp practices of the producing nations, powerful trade houses, and professional floor traders, Joe felt that the outside coffee speculator was playing in a game with a loaded deck.

1985年10月初,乔做多糖,做空黄豆,赚了很多。那时候,大部分市场早就有了既定的趋势。投机做多的经纪商太多了,他们在市价之下有大量的止损卖单。在这种情况下,乔觉得如果专业的空头交易者袭击一下的话,市场会很脆弱。他觉得那是多头气势较弱的市场,因此,他没有参与。他要找的是没有那么多人挤在里面的新战场,他慢慢地将注意力放到咖啡豆上面。乔从来不交易咖啡豆——事实上,他根本不喝咖啡!从生产国,强而有力的交易商和专业现场交易者的实际做法来看,乔觉得咖啡豆的投机者都是挤在一起玩。

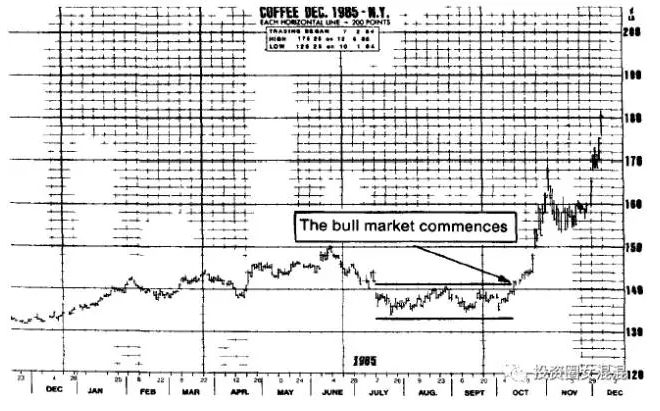

But events that were shaping up convinced Joe to take a second look at this volatile market. Recent price action revealed the major trend was sideways, with the market finding strong support on setbacks to the 134.00 level (basis December) and resistance on rallies into the 140.00 to 141.00 zone. This broad sideways trading range had been ongoing since mid-July; in fact, Joe had made a few countertrend trades, buying on reactions toward the bottom of the trading range and selling on rallies toward the top. During the last few months, Joe had reaped some small but meaningful profits. The more Joe studied the technical aspects of this coffee market, the more he came to focus on the significance of an eventual breakout from this 134.00 to 141.00 sideways trading range (see Figure 3-1).

但是形势在改变,乔重新观察这个波动剧烈的市场。最近的价格显示主要趋势是横向盘整,回调到134.00(即期12月)有强大支撑,反弹到140.00——141.00间有压力。从7月中旬以来,就一直呈现这么宽的横向盘整区间。乔做了几次逆势交易,在价格跌到区间下档时买入,涨到区间上档时卖出。近几个月,乔赚了一些小钱,也觉得很有意思。乔对咖啡豆市场的技术面研究得越多,越觉得这个市场迟早要突破134.00——141.00的交易区间(见图3-1)。

图3-1 1985年12月咖啡豆 (文字:多头市场开始)

【Between July and October 1985, futures were locked within a tight range from 134.00 to 141.00. Astute technical traders premised that a breakout (on close) in either direction would set the stage for the next big move, and they were right. On October 10, the December future closed at 141.65 – the bull market had begun! The market ultimately reached the 270.00 level, basis nearest future, before the move ran its course.

1985年7月-10月间,期货锁定在134.00-141.00间。精明的技术交易者看出,不管是往哪个方向突破(收盘价),都会为下一步的大行情奠定基础。他们是对的。10月10日,12月期货以141.65收盘——多头市场开始了!价格走完多头行情前(即期),最后涨到270.00。】

But in which direction would it pop? Joe didn't know. But he did project that, once it closed outside of this range, there would likely be a big move, and he intended to be in on it.

但是它会往哪个方向突破呢?乔不知道。不过有一点他有把握,那就是一旦收盘价落在区间之外,可能会有很大的行情,而他希望这种事情发生的时候,他正好建完仓。

During the week of October 7, the market became very quiet. Like the calm before the storm, this suggested that something big was about to happen. Joe left open orders with his broker to buy a quantity of Decembers at 141.60 stop and to sell at 133.40 stop; in the event of either order being filled, he would cancel the other one. This meant that he would remain on the sidelines while prices were locked within this broad trading range but he would get aboard as soon as the market popped out of the range in either direction.

10月7日那一周,市场非常沉静。就像暴风雨前的宁静,这表示有大事要发生。乔向他的经纪人下了开放式交易委托单,买入一定数量的12月期货,进场点设在141.60,同时卖出同样数量的12月期货,进场点则设在133.40。如果某张委托单成交,就取消另一张单子。这表示,如果市场还是在原来的区间内上下起伏,那么他会待在场外,当市场往任何方向突破,他会马上进场。

Joe didn't have long to wait. On the morning of October 10, the December coffee future opened at 138.80, traded within a 300-point range during the session, and closed at 141.65 – up 229 points from the previous close. That was what Joe had been waiting for, and he bought a substantial long line for both his clients and himself between 141.60 and 141.80.

乔没有等太久。10月10日上午,12月咖啡豆期货以138.80开盘,全天在300基点内上下波动,最后以141.65收盘,比前一天收盘价涨了229基点。这就是乔一直在等待的机会,他在141.60——141.80间帮客户和自己大量买入。

Joe was pretty comfortable with this position because the market had broken out of a broad base area trading range and now looked much higher. The next area of resistance was at the level of the 1984 highs around 160.00 (basis weekly close, nearest future). He would be buying more on stop just above this 160.00 level. But most of his clients were nervous about the position, and, during the following days, they let him know it. Just about all the Street's market letters and advisory services were bearish, including some prominent and presumably well-connected fundamental reviews. And here was Joe, plunging on the long side.

乔对自己的仓位相当放心,因为市场已经突破宽广的横向盘整区间,看起来涨的很高。下一个阻力位在1984年160.00附近的高价(即期每周收盘价)。在160.00以上他还会买入更多。但是他的大部分客户都对所建的仓位感到紧张,接下来几天,都把自己的不安告诉了乔。他们有这种情绪,是因为华尔街几乎所有的市场报告和咨询机构都一致看空,包括一些很有名可能关系网很大的基本面评论报告。而乔却突然做多。

His clients' inquiries ranged from very curious to mild panic, but his stock reply was, “It's a bull market.” In mid-November one of his larger accounts, who had apparently read one of these bearish reports recommending shorts, demanded to know why Joe had plunged on the long side of coffee. Joe realized that any simplistic technical analysis would fall on deaf ears and that the caller wanted to hear something that he would understand and could logically relate to the current market situation. Gazing out his window during much of this conversation, Joe could see the bleak, cold skies of an impending cold front – and the logical explanation was then revealed to him! Joe matter-of-factly informed his client that, since we were approaching winter, the first serious frost would damage the trees and reduce the crop. Joe wanted to be long because the frost would put the market up. The pieces did logically fit and seemed to satisfy his client, so Joe decided to use the same story on anyone else who called.

客户的询问,从非常好奇到比较恐慌的人都有,但是他一成不变的回答总是:“那是多头市场。”11月中旬,他的一位大客户读了一篇建议做空的报道,打电话要求乔解释突然做多咖啡豆的理由。乔知道,简单的技术分析,有些人就是听不进去,打电话来的人一定要听到某些他能理解,而且合乎逻辑的解释。通话的时候,乔正好对着窗外,看到了阴冷的天空,显示一波寒流就要来临——突然间,他灵机一动,找到了合乎逻辑的解释!乔装模作样地对客户说,寒冬已近,第一道严重的霜害会伤害植物,减少收成。乔做多是因为霜害会促使价格上涨。这番说词合情合理,客户似乎听得很满意,因此乔决定下次再有人打电话来问,他就用同样的回答。

The market did follow Joe's bullish scenario and began a good advance up and out of its broad sideways trading range. On the following weekend when Joe was idling about, he suddenly recalled that Brazil, being south of the equator and in the southern hemisphere, would be enjoying balmy summer weather in December. Winter… frost… crop damage … indeed!

市场确实是乔所预料的多头趋势,开始上涨,脱离了宽广的横向盘整交易区间。接下来的那个周末,乔闲着没事干,突然想到巴西其实是在赤道以南,而12月巴西应该是温暖的夏天。严冬……霜害……收成伤害……全是一派胡言!

Having bought his original line of Decembers between 141.60 and 141.80-and having pyramided twice on the advance-Joe had the distinct pleasure of watching the market soar to over 180.00. Profits were over $14,000 per contract when they expired in December. And the market didn't stop advancing till it reached the 270.00 level, basis nearest future, before falling. That's the end of Joe's “simple”story.

乔在141.60-141.80间开始建仓12月期货,而且在上涨途中两次金字塔加仓。看着价格涨到180.00以上,当然是件赏心悦目的事。合约在12月到期时,每份合约利润有14000元以上。而且价格还在涨,最近月份期货涨到270.00才开始下跌。乔那简单的故事讲完了。

But it's not the end of mine. The very graphic lesson here is that we are traders dealing in a difficult and leveraged speculative environment, and success will come only to those who keep it simple in a disciplined, pragmatic, and objective manner. Like Joe, I would rather be right for the wrong reasons than wrong for the right ones.

但是我的故事还没讲完。我们上了生动的一课:我们这些交易者是在十分困难,以小搏大的环境中打拼,成功是属于那些严守纪律,务实和客观的人。就像乔,我宁可因为错误的理由而做对,也不愿意因为正确的理由却做错。

It is particularly important for traders to keep things simple because just about everything you read or hear about the markets appears to be so complicated. The crosscurrents, contradictions, and contrasts that seem to confront commodity traders these days are more confusing and ambivalent than at any time in my memory. So what's a trader to do?

对交易者来说,最好把事情简单化,因为你在市场中看到或听到的每一件事情都是那么复杂。商品交易者现在碰到的反对意见、不同建议和不同观点,比我记忆中的任何时刻都更加混淆视听,把人搞的眼花缭乱,无所适从。那么交易者要怎么办?

In December 1985 – just when we had accepted the fact that inflation was on the wane – the leading business daily told us that worldwide inflation had actually intensified rather than eased. And then, just as the leading commodity chart service had convinced us that commodity prices were positioned for a gradual across-the-board increase, we read the following in Newsday (December 4, 1985):

1985年12月——就在我们相信通货膨胀日趋沉寂的时候——一份著名的商业专业报纸却告诉我们,全世界的通货膨胀实际上已经加剧,而不是缓解。接着,就在著名的商品趋势图公司卖给我们的图表显示各类商品价格蠢蠢欲动之际,我们看到了《新闻报》里面有这么一段话(1985年12月4日):

A growing oversupply is likely to depress commodity markets until the end of the decade…a U.N. report said. Though prices may rebound, the overall recovery in demand will remain weak in major industrialized countries at least through next year.

联合国一份报告说:供给过剩越来越严重,可能会抑制商品市场,直到89年结束……虽然价格有可能反弹,主要工业国的需求还是很弱,复苏现象至少会拖到明年。

“At least through next year” – what happened to “until the end of the decade” in the very same paragraph? What's a trader to do?

“至少会拖到明年”——那么同一段中说“直到89年结束”又是怎么一回事?交易者要怎么办?

Every time soybeans have a strong rally, we are informed that the drought in Brazil is worsening, causing unspecified damage to its soybean crop. Predictably, whenever the bean market declines, we are informed that rain or good growing weather is expected in Brazil or our Midwest. Ditto for coffee, which has thrilled agile traders with both a major bull and bear market in rapid succession, both far surpassing anyone's most optimistic forecasts. And what about sugar, another high-flying rollercoaster market. The commentators inform us that rallies are caused by increased demand for sugar plus the likelihood of smaller crops; and that reactions are caused by reduced demand for sugar and the likelihood of larger crops. What's a trader to do?

每当黄豆强劲上涨的时候,我们就会听到巴西的干旱日益恶化,对黄豆收成造成了数量不明的伤害。可以想象,每当黄豆价格下跌的时候,我们就听到巴西或我们中西部喜获甘霖或气候对作物生长有利。咖啡豆的情况也一样,大多头和大空头市场迅速交叉出现,趋势超越任何人的最乐观预测,连身手敏捷的交易者也为之震颤不已。糖是另一个大起大落的市场。商品评论家告诉我们:糖上涨的原因是需求增加和收成可能减少;糖下跌的原因是需求减少和收成可能增加。交易者要怎么办?

I can tell you what this trader does under such ambivalent circumstances. He goes back to the drawing board, which, in this case, means the charts, both daily and long term historical studies of seasonal price tendencies, and his trusty old Kroll/Wilder Long Term Computer Trading System. Combined with these technical tools is a strong conviction, born out of nearly 30 years of practical experience, that a rigorous, objective trend-following analysis, coupled with the discipline to believe in and adhere to the projections derived from that analysis, is clearly the best way to play the markets. The overriding objective of this strategy is to make more on your winning trades and lose less on your losing ones. Pragmatic analysis and trend projection of markets plus a viable strategy are absolutely essential. This was well articulated by Jesse Livermore when he said, “There is only one side of the market, and it is not the bull side or the bear side, but the right side.”

我可以告诉你,在这种公说公有理,婆说婆有理的情况下,交易者该怎么做。碰到这种情况时,交易者应该回到桌面,这里我指的是去看商品趋势图。除了研究日线级别的趋势,还要研究长期历史性和季节性的价格倾向,同时要分析可靠的克罗/怀尔德长期电脑交易系统。这些技术工具是经过约30年实战经验积累出来的心血结晶,一并使用,可以给人很大的信心,相信严谨和客观的趋势跟踪分析,加上信奉和遵守经过分析所得的预测,显然是进出市场的最好方式。这套策略极其客观,可以使你赚钱的仓位赚的更多,亏钱的仓位亏的更少。务实的分析和对市场趋势的预测,加上有效的策略绝对是最本质的。杰西·利弗莫尔讲得十分明白:“市场只有一个方向,不是多头,也不是空头,而是做对的方向。”

On the subject of “the right side,” I recently traveled to Los Angeles to conduct a weekend seminar on futures trading strategy in conjunction with long-term trading systems. My presentation was divided into two segments – first, a discussion concerning long-term trading systems whose objectives are capital appreciation within the bounds of acceptable risk and capital drawdown; second, the trading strategies that should be utilized in conjunction with trading systems to achieve these objectives.

谈到“做对的方向”,前不久我去了洛杉矶,在一个周末研讨会上演讲,讨论如何融合期货交易策略和长期交易系统。我的演讲内容分成两部分——第一部分谈长期交易系统,它的目标是在可接受的风险和止损下,如何求取资本增值;第二部分我讲到交易策略应配合交易系统才能达成前面所说的目标。

To say that the two dozen investors at my seminar were sharp and well-prepared would be an understatement. I was kept on my toes for the entire two days and was constantly impressed with the dedication and sophistication that these nonprofessional speculators clearly demonstrated. By and large, they knew their computers and the various logistics of opening and managing their trading accounts. They were receptive and eager to learn all they could about trading systems and concomitant strategies.

如果说来参加研讨会的20多位投资者都很聪明,而且有充分的准备,这还不够。在这两天的研讨课程中,我很紧张。这些非专业投机者全神投入并思虑周全,给我留下了很深的印象。大体来说,他们懂电脑,对开户和管理账户也都了如指掌。他们愿意并渴望学习交易系统和附属的策略。

After teaching them the technical aspects of how to use the computer in conjunction with trading systems, I dealt with the other half of the equation – the strategy of successful operations. Here I stressed the importance of sticking to simple and basic tenets of sound money management. Personal discipline, self-sufficiency, and pragmatism are the crucial characteristics of the successful speculator, but they are the most difficult virtues to teach. And, after you learn them, they are still the most difficult virtues to practice.

把如何融合交易系统和交易策略的电脑技术教给他们之后,我讲到另一半——成功交易的策略。在这里,我强调了要遵守简单和基本的原则:优秀的资金管理十分重要。成功投机者最重要的素质是严守个人纪律,依赖自己,要务实。但是这些美德是最难教的。而且,就算学会了,实际应用上还是十分困难。

Part of the equation of successful speculation requires the operator to undertrade, both in terms of the size of his position and the frequency of turnovers. Excessive trading involves additional costs of commissions and breakage. Even more onerous, it places the operator in a mental and emotional position totally at odds with the imperative of sitting with winning positions for the full duration of the favorable move. I hold that it is irrelevant to think about the length of staying aboard a position solely in terms of its time duration. “Do you hold a long-term position two months, three, four?” I have frequently been asked. “Nothing like that,” is my typical response. You hold a position for as long as the market continues going your way; you let the margin clerk, the trading system you are using, or an objective chart analysis tell you when the market has turned against you (more on this important topic in later chapters).

投机要成功,同时要求交易者无论是在建立仓位的大小上,还是交易的频率上,都要比一般水准低。过度交易会增加手续费和发生亏损。更糟的是,这么做,会使交易者所处的精神和情绪状况完全跟应该有的情况背道而驰。正确的做法是碰到趋势对自己有利时,交易者应该保持从容的态度,稳坐赚钱的仓位,不要轻易去动它。我确信单以时间的长短来决定要持有多久是不对的。经常有人问我:“长期仓位要持有2个月、3个月还是4个月?”我通常回答说:“没人这么问的。”只要市场对你有利,不管多久,仓位都要继续持有。你什么事情都不要管,让期货公司,你所用的交易系统或者一份客观的图形分析来告诉你,市场什么时候开始对你不利(后面几章还会就这个重要的主题多谈一些)。

Clearly, if you can develop the technique and the strategy of sitting with profitable positions for the major move, and have a system or technical method to get you out of adverse positions before the losses get onerous, you don't have to start with a huge amount of capital in order to have the potential for profitable results. Traders who stress accuracy of trade timing, both entry and exit, can start with as little as $15,000 or $20,000. This modest opening equity leaves very little room for error. Nevertheless, the market has always functioned as the great equalizer of wealth, rewarding the patient, disciplined, and able players while punishing the careless and inept ones, regardless of the size of their starting capital. It is possible to rack up a consistent and impressive score from modest starting capital, to which I can attest from personal experience. The annals of finance are replete with true-to-life stories of powerful and wealthy capital accumulations that began from small but talented operations in the futures markets.

很显然的,只要你能发展出你所需的技巧和策略,碰到大行情时持有赚钱的仓位不放,而且你有一套系统或技术方法,能在损失一发不可收拾之前,赶紧平掉仓位,那么一开始你并不需要为了大赚一笔,而投下庞大的资金。强调准确进出时机的交易者,开始时可以用低到15000-20000元的资金进场。这笔金额不大的进场资金,发生错误的空间非常小。而且,市场就像一个伟大的财富分配器,它不会考虑任何人的资金大小,它只会奖赏有耐心,有纪律,有能力的人;惩罚漫不经心,不称职的人。根据我的亲身经历,不多的启动资本,也有可能产生持续不断和可观的利润。期货市场中,充满着靠着小钱起家,凭智慧发财的真实

每日精彩,欢迎扫描二维码关注期乐会微信公众平台。

感谢作者辛苦创作,部分文章若涉及版权问题,敬请联系我们。

纠错、投稿、商务合作等请联系邮箱:287472878@qq.com